Philanthropy vs pandemics

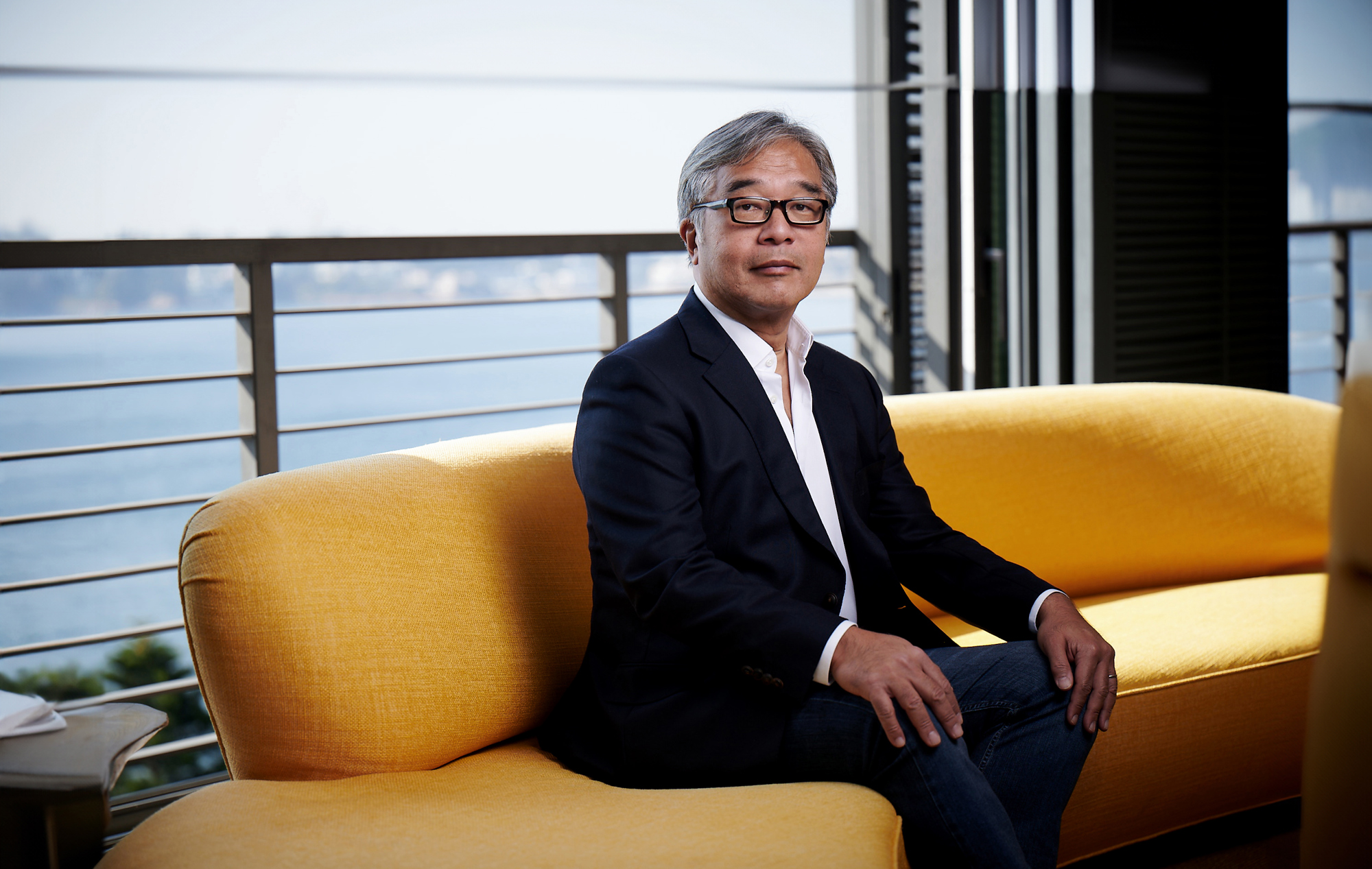

Catalytic social investments could play a crucial role in combatting global health issues, say philanthropist James Chen

Wednesday, 01 July 2020

Catalytic social investments could play a crucial role in combatting global health issues, say philanthropist James Chen

Wednesday, 01 July 2020

James Chen is Chair of the Chen Yet-Sen Family Foundation, a Hong Kong-based charity foundation with a strategic focus on early childhood literacy, library development and education enhancement. This column was first published by the World Economic Forum.

James Chen is Chair of the Chen Yet-Sen Family Foundation, a Hong Kong-based charity foundation with a strategic focus on early childhood literacy, library development and education enhancement. This column was first published by the World Economic Forum.

The annual global cost of pandemics is anywhere between $570bn and $4tn per year, depending on severity, according to estimates by the Coalition for Epidemic Preparedness Innovations (CEPI). Looking at the economic paralysis that has gripped so many countries across the world due to Covid-19, it’s easy to understand why.

What is harder to understand is why this was not more widely anticipated. The SARS and MERS outbreaks of the past two decades were fatal warnings that a global epidemic of this scale could be lurking, while the 2014 Ebola outbreak in West Africa took more than a year to contain – despite a vaccine being in development for more than 10 years.

In the midst of that crisis in 2015, Bill Gates explained that the high mortality rate of Ebola meant the spread ultimately contained itself, as the illness is so severe it renders victims bed-ridden at the point of contagion.

“Next time, we might not be so lucky,” he said. “You can have a virus where people feel well enough while they’re infectious that they get on a plane or they go to a market.”

Gates is the leading voice in the current generation of private philanthropists around disease prevention and response. He has helped initiate and manage a number of organisations such as the Global Health Investment Fund. Structured by Lion’s Head, its capital contribution has been very successful in crowding private sector investment in disease control.

It is this type of giving, which stimulates change through “high risk, high-reward” action, that should define what it means to be a true philanthropist, someone at the summit of Maimonides’ hierarchy of giving.

Like any early stage business venture, this approach – what I call catalytic philanthropy – involves putting in loss-absorbing capital and building domain expertise on an issue to bring about long-term change. It is about investing time, nurturing expertise and aligning your investment with your values and insights while expecting no financial gain in return.

Philanthropists can direct their patient resources to fund iterations of hypotheses with experiments to discover long-term solutions to seemingly remote or intractable societal problems without the pressure for immediate results that other investors might seek.

Unlike others, Gates’ years of commitment to tackling infectious diseases means that when he redeployed his resources into finding a Covid-19 vaccine, it could be considered as more than just charity, but real change-making philanthropy.

He follows in the footsteps of some of history’s greatest philanthropists, who themselves dedicated much of their wealth to building expertise to tackle the greatest health crises of their own times. J.D. Rockefeller, perhaps the early 20th century’s most famous philanthropist, gave away $530m during his lifetime, $450m of which – or around $8.5bn today adjusted for inflation – went into medicine.

While he was best known for his more traditional charitable giving, the legacy he left paved the way for generations of his descendants to practice catalytic philanthropy, with Rockefeller-endowed philanthropic entities instrumental in finding vaccines for hookworm and yellow fever and providing critical aid and vaccinations to soldiers in the First World War.

Beyond this current pandemic, philanthropists need to ensure they activate their funding for other global health issues while ensuring we are more prepared for the next pandemic.

One of the ways this can be done is through advanced purchasing commitments such as the Gates-supported Gavi vaccine alliance. Like grand prize competitions, these commitments incentivise a market response for greater industry investment in the development and launch of the next vaccine needed.

There are many other challenging but high-impact issues that need patient exploration with high-risk capital and perhaps other diseases would benefit from an advanced purchasing commitment.

"Philanthropists need to ensure they activate their funding for other global health issues while ensuring we are more prepared for the next pandemic."

Philanthropy played a vital role in funding vaccine research in the Covid-19 pandemic. Photo: Getty.

Catalytic social investments by philanthropists play a crucial role in building underappreciated models and private philanthropists, as owners of capital, are uniquely positioned with the financial freedom to act when others are unwilling or unable.

They are unlike governments in that they are not beholden to an electorate, and unlike businesses who are accountable to their shareholders with shorter time horizons and lower tolerance for risk.

In this pandemic, we have seen this through the patient capital invested to jumpstart vaccine candidates. This form of philanthropy is invaluable across the spectrum of global health issues.

My work in poor vision has demonstrated how risk capital and domain expertise can bring about major changes. Poor vision is the largest unmet disability in the world, with estimates of up to 2.5 billion people affected today.

In conjunction with the Rwandan government, our NGO, Vision For a Nation, achieved the previously unthinkable objective of making Rwanda the first developing country in the world to provide affordable eye care for all.

This global campaign is making great strides in encouraging world leaders to prioritise the issue of vision correction by reframing it as a way to hasten SDGs, rather than a low-priority and siloed health issue.

While all social sector funding is perceived as of equal value, I would argue that a dollar invested in risk-taking capital has far more value. It is these dollars, without the burdensome restrictions and impact-diluting caveats often incumbent with risk-averse institutional funding, that have the freedom to create real-world change.

In this case, it is the risk capital that will have put in place the flexibility to turn around a vaccine faster than ever before.

In the context of life beyond coronavirus, governments are absorbed by the present – providing loans and funds to help people survive, supporting healthcare and keeping peace – and most businesses are distracted or crippled.

There is a tremendous opportunity and necessity for the world’s philanthropists to embrace the catalytic philanthropy approach and take the lead in focusing on the many other challenging issues, - in health and beyond - facing our world today, before they too become critical and calamitous.

This article was first published here by the World Economic Forum.

It's a good idea to use a strong password that you're not using elsewhere.

Remember password? Login here

Our content is free but you need to subscribe to unlock full access to our site.

Already subscribed? Login here